The term “BSC” is becoming more and more popular and is an extremely effective method in corporate governance.

The effectiveness of BSC has helped it quickly be applied by thousands of businesses, government agencies, and non-profit organizations around the world, including Vietnam. In the results of the global survey of management tools in 2011, published by the consulting firm Bain, BSC entered the top 10 most widely used management tools in the world (6th place).

So do you know what BSC really is? Let’s discover together with Malu now.

>>> What is Kaizen? Management according to 5S . standards

What is BSC?

BSC stands for Balanced Scorecard , translated into Vietnamese as “Balanced Scorecard”. It is a strategic management system based on measurement and evaluation results, applicable to every organization. In other words, BSC is a method of converting vision and strategy into specific goals, evaluation criteria and activities.

The Balanced Scorecard is often used in the strategic planning process to ensure a company’s efforts are aligned with the overall strategy and vision.

However, is BSC really a miracle tool in corporate governance?

What is the origin of the BSC Balanced Scorecard?

To understand in detail what BSC is, let’s learn about the origin of this system.

In 1992, Dr. David P. Norton and Robert S. Kaplan formed a working group to study the challenges of reporting on financial ratios alone.

In for-profit organizations, financial ratios provide lagging reports (that is, they show what happened last month, last quarter, or year ago), but they are not visible to metrics. Future. Norton and Kaplan wanted to look specifically at metrics that could be detected in a timely manner that serve as leading indicators influencing an organization’s strategy.

Why do businesses need a Balanced Scorecard?

It was created to help businesses evaluate their operations, not only with a financial eye using revenue, costs and profits, but more. The BSC presents a balanced view that also takes into account other perspectives on success.

The Balanced Scorecard effectively addresses the limitations of short-term financial measures and reflects past results by adding metrics that drive future business growth.

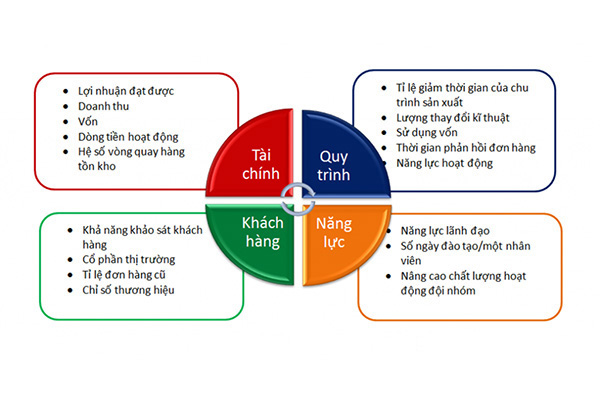

BSC proposes that we must look at an organization from four perspectives and build a measurement system, collect data and analyze them in relation to each other: Financial, Learning & Growth, Internal Business Processes and Customers.

These four aspects form the framework for the causally aligned Balanced Scorecard, which emphasizes that a good and sustainable financial outcome depends on customer satisfaction, customer satisfaction, and customer satisfaction. Customer satisfaction depends on the ability to create products and services that meet customer needs.

This again depends on the quality and implementation of internal processes of the enterprise, and the effectiveness of the implementation of internal processes depends on the ability to develop knowledge and skills of human resources, organizational capacity. information capacity.

These activities are noted in the appropriate sections with stated measures, subjects and objectives for data collection and analysis. The activities can then be properly calculated and evaluated.

Four aspects of the Balanced Scorecard

Based on the BSC model, business managers can evaluate the parts of the business that can create value for current and future customers and the requirements for improving internal capabilities. and the investment in people, systems and processes to improve future business performance.

1. Financial aspect (Financial)

Finance in a balanced scorecard is likely the most traditional of the four. You will want to review, measure and monitor financial requirements and results such as return on investment, growth, fixed costs, profitability, etc.

Financial ratios define the long-term goals of a business unit, enterprise or organization. While profit targets are more commonly used, other financial goals can be used. Depending on the stage of development in the cycle or the state of the business, a business may focus on different growth goals.

Professors Kaplan and Norton outline the three stages of business strategy as follows:

- Growth : associated with the early stages of the product life cycle and often requires more investment and is long-term.

- Retention: Associated with the saturation phase of the product’s life cycle. During this period, businesses still need to invest and reinvest, but require a higher rate of return, and focus on maintaining current market share.

- Harvest : Associated with the maturity stage of the product’s life cycle. During this period, the enterprise only invests to maintain its current capacity, not to expand its business operations, and towards the goal of a quick return on investments.

In each phase, a business can focus on one or a combination of financial themes:

- Revenue growth strategy (expanding product/service lines, increasing new applications, new customers and markets, changing product structure to increase value, re-pricing products and services…).

- Strategies to cut costs or increase productivity: Increase productivity (revenue), reduce average cost per product unit, improve distribution channel efficiency, reduce operating costs (administrative selling expenses) ).

- Investment strategy and exploitation of investment assets: Reducing working capital needed to support operations such as shortening days of receivables, days of inventory, increasing days of payables, exploiting fixed assets, increasing scale and/and increase productivity.

2. Learning & Growth aspect

This area examines the company’s position on training employees in rapidly changing technologies, advising employees on ways to help them grow and contribute, and using the latest tools and systems to promote innovation. You may also want to check how quickly your company responds to change and how long it takes for a team to develop a new product and bring it to market.

The learning and growth aspect includes three main sources: people, systems, and organizational processes. The financial, customer, and internal process objectives in the balanced scorecard will often reveal the gap between the capabilities of people, organizational systems and processes, and what is needed to achieve a breakthrough in performance. organization results.

To close this gap, businesses will have to reinvest in upgrading skills, strengthening information technology systems, and linking organizational processes and procedures. Goals are central to the learning and growth perspective.

Measures for human resources are a combination of a range of factors: employee satisfaction, employee loyalty, employee training, and employee skills. Information technology systems can be measured by the availability of accurate information about customers and internal processes to employees.

Organizational procedures can be viewed in terms of the degree to which employee compensation aligns with the organization’s core success factors and measured by the degree of improvement in relation to internal processes and client.

3. Internal process of the enterprise (Internal Process)

In the internal process aspect, the business must identify the core internal processes in which the business needs to invest in order to excel, examine the areas that need improvement by eliminating inefficiencies. and identify error-prone parts. Internal processes are considered core if they help the business:

- Provide value to customers in the target market

- Satisfying customers’ expectations for high profit margins.

Metrics should only focus on the internal processes that have the greatest impact on customer satisfaction and the realization of the business’ financial goals.

To identify metrics that truly measure their ability to create value for customers and shareholders, organizations on the one hand measure and control current internal processes using quality metrics. quality and time, on the other hand, more importantly, they must identify processes that define entirely new processes that the business needs to excel at (see Table 2). These processes should be key to ensuring the business successfully executes its strategy.

Kaplan and Norton (1996) emphasize that the difference from the traditional approach is that internal processes are integrated with innovation processes – focusing on new market development, new needs and growth. develop new products and services to satisfy the new needs of current and future customers. These are the long-term value-creation processes that ensure the achievement of an organization’s long-term financial goals.

4. Customer aspect (Customer/Stakeholder)

You will want to examine your company’s activities from the perspective of customers or stakeholders. How do your customers view your activities? What are the reviews and feedback? Do you have an objective measure of customer satisfaction from surveys or other sources? A negative perception of your business or product can lead to reduced sales in the future.

Objectives in the customer perspective focus on measuring the performance of the business on the target market segment and measuring the value delivered to the customer. These are important factors that contribute to the superior financial results of a business.

To measure the performance of the business on the target market segment, objectives such as increasing customer satisfaction, attracting new customers, profit from customers, percentage of target customers are determined. use. These are the core goals of the customer aspect. These metrics can be used for most types of organizations, but they need to be tailored to the target customer groups you want to focus on.

To be effective in the target market, the business must provide value that meets the needs of customers. So these values also need to be measured. The concept of customer value schema was added by Kaplan and Norton (1996) to the customer aspect. Customer value diagram represents the attributes of products and services that businesses provide to create satisfaction and loyalty of target customers. Although there are differences between industries and sectors, the attributes in the value map can be divided into three groups:

- Product/service attributes: include factors such as difference, features, quality, price, and delivery time.

- Customer relationship: related to the process of providing products and services to customers, including customer response and delivery time and how customers perceive the buying experience of the business.

- Image and reputation: allows businesses to position in the minds of customers.

Practical applications of the Balanced Scorecard

Innovative companies often use the BSC Balanced Scorecard as a strategic management system to manage their strategy over the long term. They focus on processes:

- Clarify and communicate vision and strategy

- Communicate and link strategic objectives and evaluation criteria

- Planning, setting goals, linking strategic measures

- Promote strategic feedback and learning

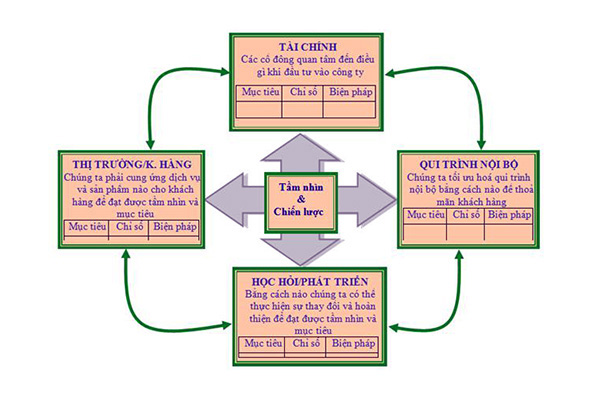

To apply the Balanced Scorecard, you can start with one space for all four dimensions and simply add those that are specific to your organization.

1. Define vision by balanced scorecard

The company’s primary vision lies at the heart of the balanced scorecard. Whatever part of your company looks at, you should always keep this goal or vision in mind. Because that is the core issue as well as the long-term development orientation of your company.

2. Add aspects in the Balanced Scorecard:

To create a traditional balanced scorecard, place four aspects in a ring around the central vision. The four aspects we covered above: Finance, Learning & Growth, Internal Business Processes, and Customers.

3. Add goals and measures:

In each aspect, you need to clearly define specific goals, measures, audiences and initiatives.

4. Connect each aspect of BSC:

Link each aspect to the other views using arrows to show that they are all connected when achieving the company vision.

5. Share and communicate:

Use the balanced scorecard to demonstrate how various short-term initiatives and actions are contributing to the company’s long-term strategic goals.

BSC – Balanced Scorecard or Balanced Scorecard should be applied throughout the company, from the top management to the employees. BSC serves best for strategy formulation and implementation, bringing comprehensive benefits to the company and its customers.

Some argue that this traditional method of scoring the Balanced Scorecard is no longer suitable for every industry or business. So, some of today’s Balanced Scorecards will add a range of different aspects, sometimes even more than the traditional four listed above.

Several Balanced Scorecards – BSCs also rely on strategy maps, which describe a series of smaller strategic goals in addition to the overall company goal. See more knowledge about Business Administration at Malu’s blog.